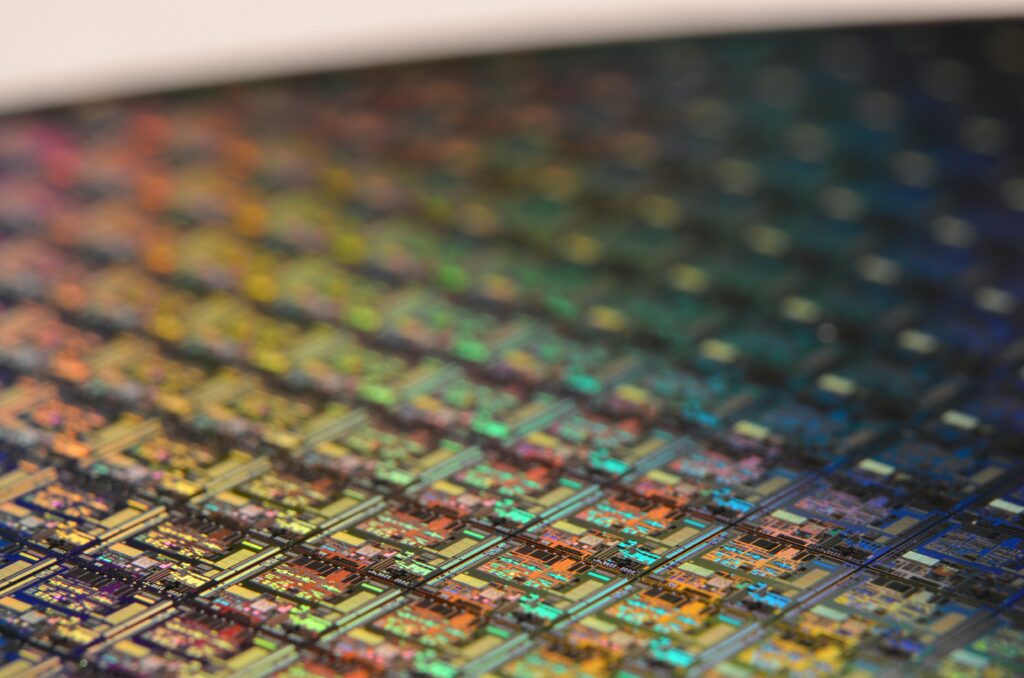

China is set to impose restrictions on the export of gallium and germanium, essential materials used in semiconductor production with military applications, as the chip war with the US intensifies. The move comes amid efforts to limit Beijing’s access to advanced microprocessor technology, and follows export restrictions imposed by other countries. The constant tit-for-tat between the world’s two biggest economies has raised concerns over “resource nationalism” and its potential impact on the global supply chain. While the short-term impact may be limited, experts urge caution as the trend may have far-reaching consequences for various industries and the environment.

impact on the overall market

The imposition of export restrictions by China on gallium and germanium, key materials used in semiconductor production with military applications, is expected to have several impacts on the market:

- Supply Chain Disruptions: China is the largest player in the global supply chain of gallium and germanium, producing 80% and 60% of the world’s supply, respectively. With restrictions in place, the supply of these critical materials could be constrained, leading to disruptions in the semiconductor manufacturing industry.

- Higher Costs and Price Volatility: Limited availability of gallium and germanium could drive up prices for these materials. Manufacturers may face higher production costs, which could be passed on to consumers, potentially impacting prices of electronics and other semiconductor-dependent products.

- Shift in Regional Dominance: As China currently dominates the production of gallium and germanium, the restrictions may prompt other countries to explore alternative sources and develop their own supply chains. This could lead to a shift in regional dominance in the gallium and germanium market over the long term.

- Rise of Resource Nationalism: The ongoing trade tensions and export restrictions between China and other countries, particularly the US, raise concerns over “resource nationalism.” Governments may hoard critical materials to exert influence and secure their own technological advancements, leading to further protectionism.

- Exploration of Substitutes and Recycling: With limited access to Chinese supplies, industries may explore alternative materials or increase efforts to recycle gallium and germanium. This could drive innovation and diversification in the market.

- Impact on Semiconductor Technologies: The use of gallium arsenide in high-frequency computer chips and germanium in microprocessors may face challenges if alternative sources are not readily available. R&D efforts may focus on finding substitutes or improving recycling methods.

- Long-Term Environmental Considerations: The pursuit of alternative sources of critical materials may have environmental implications. Increased mining and processing could raise concerns over sustainability and responsible sourcing practices.

- Heightened Geostrategic Competition: The restrictions on gallium and germanium exports are part of broader geopolitical tensions between major economies. The competition for access to critical materials may further intensify geopolitical dynamics.

- Opportunities for Mineral-Rich Countries: Countries with significant mineral resources, such as Australia and Canada, may see opportunities to fill the supply gap and emerge as major players in the gallium and germanium market.

- Uncertainty in Technological Advancements: The uncertainty caused by export controls could slow down technological advancements and the development of new applications that rely on gallium and germanium, affecting industries like high-frequency electronics, LEDs, and solar cells.

Overall, the impact of China’s export restrictions on gallium and germanium is complex and will unfold over time. Market participants will need to closely monitor the situation and adapt their strategies to navigate the changing landscape of critical material supply and demand.